Energy infrastructure is the lifeblood of our modern world. It’s the unseen network that powers our homes, businesses, and industries. Without it, our society would grind to a halt. In a world where attention often focuses on the latest and greatest tech innovations, acknowledging the lasting importance of this essential infrastructure sector is critical. This paper explores how energy infrastructure not only underpins our daily lives, but how its foundational significance is designed to offer stable, income-producing opportunities for investors coupled with long-term growth prospects.

Big Picture: Essential Infrastructure Assets

Infrastructure assets share these common characteristics that seek to provide valuable investments over the long haul:

- Predictable cash flows targeted to increase over time with economic growth.

- Physical assets with useful lives often exceeding than 20 years.

- Highly regulated and cost-prohibitive to replicate.

- Resilient demand during economic downturns.

Recognizing the interconnectedness of the various essential infrastructure sectors is vital. Each one plays a distinct role in sustaining modern life:

- Power Infrastructure: Generates, transmits, and distributes electricity, providing the energy necessary for countless applications.

- Renewable Infrastructure: Focuses on harnessing clean energy sources like solar, wind, and hydro power to reduce reliance on fossil fuels.

- Communication Infrastructure: Enables the flow of information through networks like cell towers, data centers, and satellites, essential for modern communication and digital economy.

- Transportation Infrastructure: Facilitates the movement of people and goods through roads, railways, airports, and ports, supporting economic activity and trade.

- Waste Management Infrastructure: Manages waste disposal and recycling, protecting public health and the environment.

Understanding Key Investment Attributes

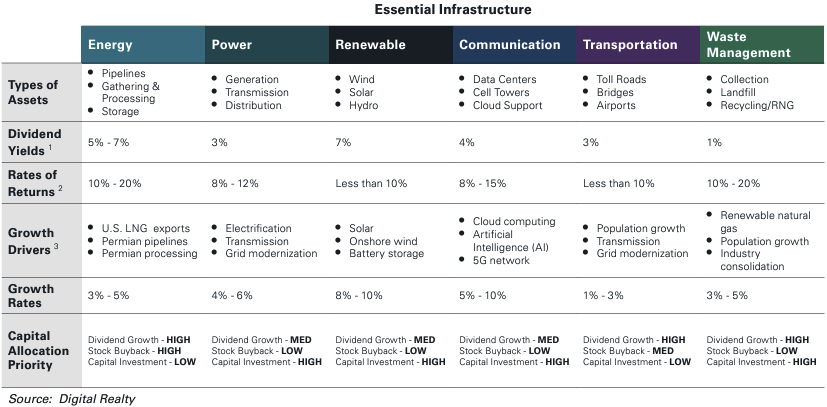

Each of the essential infrastructure sectors has unique growth drivers beyond population and GDP growth, which are expected to boost cash flows and rates of return at varying levels. The table below highlights these sector-specific investment attributes:

The Backbone of Essential Services

Energy infrastructure is the backbone of essential services, connecting energy production to residential end-users and industries across the board. The U.S. energy infrastructure network includes:

- Gathering Systems: Over 100,000 miles of smaller pipelines connected to well production sites.

- Processing Plants: Approximately 500 plants refining hydrocarbons.

- Natural Gas Pipelines: Over 200,000 miles delivering gas to various facilities.

- Crude Oil Pipelines: An 80,000-mile network transporting oil to refineries and export locations.

- Natural Gas Liquid (NGL) Pipelines: Over 70,000 miles delivering ethane, propane, butane, and natural gasoline.

- Storage Terminals: Nearly 1,500 above-ground terminals and 400 underground storage facilities.

- Liquified Natural Gass (LNG) Terminals: Eight primary export facilities.

- Refined Product Pipelines: Over 62,000 miles distributing gasoline, diesel, and jet fuel.

- Local Distribution Lines: Nearly 1.5 million miles of pipelines serving end-users.

- Shipping Vessels, Railroads, and Trucks: Complementary transportation methods for energy commodities.

Key financial attributes of the energy infrastructure sector include:

- High Dividend Yields: Average between 6% and 7%, appealing to income-oriented investors.

- Regulated Assets and Rates of Return: Generally ranging between 10% and 20% over the past 20 years.

- Modest Growth Outlook: Driven by population growth, GDP growth, and expanding energy production 20%.

- Limited Capital Investment Needs: Allowing for meaningful free cash flow after dividends.

Summary of Other Infrastructure Sectors

Below is an overview of the key functions and investment attributes of the other infrastructure sectors:

Power Infrastructure: includes electricity generation, transmission, and distribution:

- Dividend Yield and Returns: Average yield of 4%, with regulated returns between 8% – 12%.

- Growth Drivers: Electrification initiatives and increased industrial activity 12% over the past 20 years.

- Capital Investment: Focus on expanding regulated asset base to meet demand growth.

Renewable Infrastructure: encompasses sustainable energy sources like hydroelectric, biomass, wind, solar, residential solar, and energy storage.

- Dividend Yield and Returns: Average yield of 7%, with project returns below 10%.

- Growth Drivers: Decarbonization efforts and technological advancements.

- Capital Investment: Focus on financing growth projects and managing financing costs.

Communication Infrastructure: supports connectivity and data transmission through cell phone towers and data centers.

- Dividend Yields and Returns: Yields averaging 4%, with returns between 8% and 15%.

- Growth Drivers: Increased wireless data consumption, 5G rollout, and data center expansion.

- Capital Allocation: Prioritizes capital investment to support growth.

Transportation Infrastructure: facilitates the movement of people and goods via roads, airports, and ports.

- Dividend Yields and Returns: Low yields averaging 3%, with returns less than 10%.

- Growth Drivers: Population growth, economic health, and globalization.

- Capital Allocation: Emphasis on dividends due to limited growth opportunities.

Waste Management Infrastructure: manages daily waste generation across collection facilities, landfills, and recycling centers.

- Dividend Yields and Returns: Low yields around 1%, with returns between 10% and 20%.

- Growth Drivers: Population growth, economic expansion, and decarbonization efforts.

- Capital Allocation: Focus on capital investment to capture growth opportunities.

Bottom Line

Infrastructure is fundamental to modern life, from supporting technological advancement to everyday economic activity. Energy infrastructure in particular is the “essential of the essential”, serving as the foundation upon which other sectors rely.

Full Paper Access

For a deeper dive into how energy infrastructure is powering the future through its essential nature and how investors can harness it in their portfolios, access the full research paper here.

Footnotes

- As of 9/30/24. Energy represent yield of Alerian Midstream Index and Alerian MLP Index. Power represents yield of Dow Jones Utility Average. Renewable is average of yields of Northland Power, Boralex, NextEra Energy Partners, Clearway Energy, Altantica Sustainable Infrastructure, Brook field Renewables. Communication average of Digital Realty Trust, Equinix, and Crown Castle.

- 2004-2024, Returns will be lowered by applicable fees and expenses. Growth rates refer to the percentage change of a specific variable within a specific time period.

- Growth rates can be positive or negative, depending on whether the size of the variable is increasing or decreasing over time.

Disclosures

The information in this piece reflects Tortoise Capital’s views and opinions as of date herein which are subject to change at any time based on market and other conditions. This commentary contains certain statements that may include “forward-looking statements.” All statements, other than statements of historical fact, included herein are “forward-looking statements.” Although Tortoise believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect, Actual events could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this publication. Tortoise does not assume a duty to update these forward-looking statements. Although information found in this commentary is derived from sources we believe to be accurate, we do not guarantee the accuracy of such information. The markets are volatile and unpredictable and there are no guarantees that historical performance will have a correlation with future performance. There is also is no guarantee the Rates of Return shown above will show similar rates of return as in the above presentation. Investing involves a risk of loss, including loss of principal. This material should not be relied upon as investment or tax advice and is not intended to predict or depict performance of any investment. This publication is provided for information only and shall not constitute an offer to sell or a solicitation of an offer to buy any securities.

Past performance is no guarantee of future results.