The Big Picture

Energy and Energy Infrastructure: The Foundation of Modern Civilization, Economic Growth, and U.S. Leadership in Global Security

Energy serves as the cornerstone of modern civilization, powering industries, households, and technological advancements. Beyond transportation and heating, energy resources—particularly natural gas, oil, and natural gas liquids (NGLs)—enable the production of over 6,000 consumer products, including life-saving medical devices like MRI machines and pacemakers. These resources form the backbone of global economic and industrial development, offering cost-effective and reliable solutions. Natural gas, in particular, plays a pivotal role in reducing carbon emissions by replacing coal in power generation.

Supporting this energy ecosystem is an equally vital component: energy infrastructure (EI). At Tortoise Capital, we emphasize, “There is no AI without EI.” Just as the circulatory system sustains the human body, energy infrastructure ensures the seamless delivery of resources that fuel technological innovation and economic progress. From powering industrial growth to connecting global economies, energy infrastructure is indispensable to modern life.

The United States exemplifies this dynamic, emerging as the world’s largest energy producer and exporter thanks to advances in shale technology. U.S. leadership ensures energy security and stability amid growing geopolitical tensions, reinforcing its role as a cornerstone of the global energy landscape. By meeting rising global demand, U.S. energy production and infrastructure are integral to sustaining economic progress worldwide.

2025 Energy Infrastructure Outlook: Positioned for Growth

2025 Energy Infrastructure Outlook: Positioned for Growth

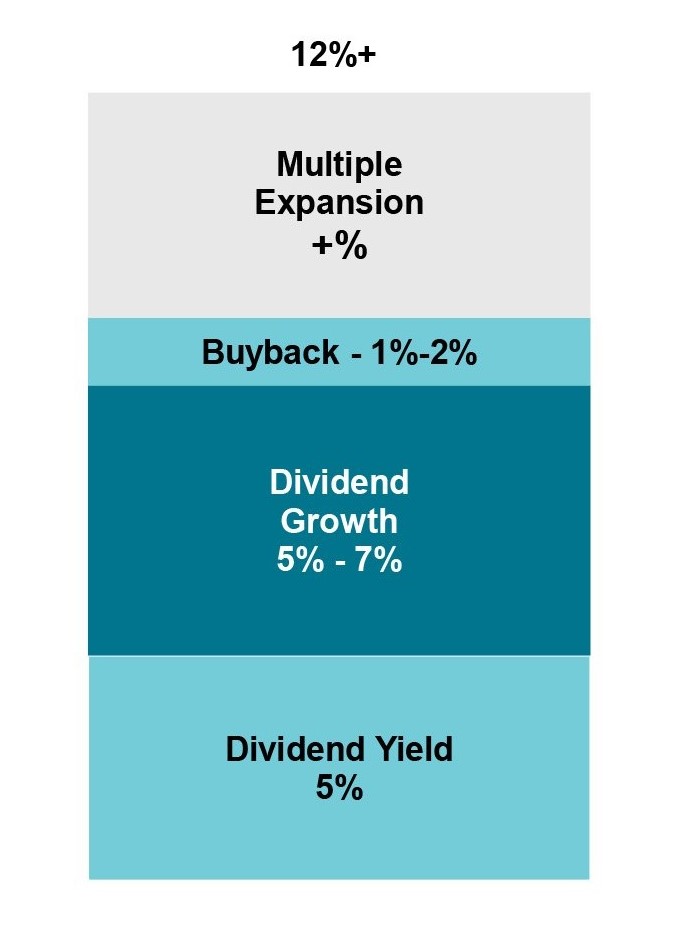

12%+ Total Return Potential: Steady cash flows and dividend growth supported by buybacks and the potential for multiple expansion.

Global Energy Demand at Record Levels: Driven by industrial growth, urbanization in developing nations, and efforts to reduce energy poverty.

Artificial Intelligence as a Catalyst: The rise of AI accelerates electricity demand, requiring robust energy infrastructure to power data centers.

Attractive Valuations: Despite strong recent performance, the sector remains undervalued, offering lower volatility and limited correlation to crude oil prices.

U.S. Leadership in Energy Exports: The U.S. leads in LNG, natural gas liquids (NGLs), and crude oil exports.

Sustainability through Natural Gas: Natural gas plays a pivotal role in reducing emissions and supporting the global energy transition.

The Details

Total Return Potential of 12%+

The energy infrastructure sector is poised for a strong performance in 2025, with a total return potential exceeding 12%. As illustrated in the chart below, this outlook is underpinned by several key drivers that position the sector for growth and income generation.

Key Drivers of Total Return in 2025i

- Dividend Yield: The Alerian Midstream Energy Index offers a robust dividend yield of approximately 5% as of December 31, 2024.

- Dividend Growth: Forecasted dividend growth of 5%–7% reflects an acceleration from last year’s estimate of 3%–5%, underscoring the sector’s improving fundamentals.

- Stock Buybacks: Companies are expected to allocate 1%–2% toward stock buybacks. With solid debt levels, attractive equity valuations, and cash flows exceeding dividend requirements, buybacks remain a core component of capital allocation strategies.

- Potential for Multiple Expansion: The integration of AI-driven growth initiatives represents a transformative opportunity for the energy infrastructure sector. This catalyst could enhance investor sentiment, paving the way for valuation multiples to expand.

Positioned for Long-Term Growth

The combination of stable cash flows, growing dividends, and a favorable macro environment highlights the resilience and appeal of the energy infrastructure sector. Furthermore, the increasing role of AI in driving new demand streams positions this sector as a compelling investment for 2025 and beyond.

Record-Setting Global Energy Demand and U.S. Energy Dominance

Global energy demand is forecast to set new records in 2025, rising for the 39th time in the past 41 yearii, fueled by:

- Industrial Growth in the U.S.: The rise of artificial intelligence (AI), reshoring of manufacturing, and cryptocurrency mining are significantly boosting energy consumption.

- Urbanization in Developing Nations: Countries like India and China are at the forefront of urbanization, contributing to increased energy requirements.

- Energy Poverty Reduction: Expanding global access to affordable and reliable energy continues to drive demand growth.

U.S. shale technology, celebrating its 20th year of commercialization, has transformed global energy markets, establishing the U.S. as a dominant energy producer. Notable milestones include:

- Natural Gas Production: U.S. natural gas output exceeds 100 billion cubic feet per day, accounting for nearly 20% of the world’s supply.

- Oil Production: The U.S. produces over 13 million barrels of oil daily, representing more than 20% of global output.

Artificial Intelligence: Energizing the Fourth Industrial Revolution

Artificial intelligence is revolutionizing energy demand, particularly through its impact on electricity consumption. As shown in the chart below, U.S. electricity demand has remained flat at approximately 4,000 terawatt-hours annually since 2010, largely due to energy efficiency measures offsetting growth from population increases. However, AI is poised to disrupt this dynamic, marking what many are calling the “Age of Electricity.”

- Data Center Demand: Data centers supporting AI applications currently consume approximately 4% of U.S. electricity, a figure that is expected to grow significantly as hyperscalers expand their facilities and deploy increasingly energy-intensive equipment. By 2030, data centers are projected to account for more than 11% of U.S. electricity consumption, highlighting their critical role in the nation’s energy landscape. This surge, alongside other drivers of electricity demand, is forecast to add over 1,000 terawatt-hours to U.S. electricity usage by 2030—equivalent to the combined electricity consumption of Texas, Florida, California, and New York today. This remarkable growth underscores the expanding energy needs of the digital age, driven by AI and other advanced technologies.

- Natural Gas’s Role: As the largest contributor to U.S. electricity generation, natural gas (43% of the fuel mix) is vital to meeting these expanding energy needs. This is especially true as annual electricity demand growth accelerates from less than 1% historically to approximately 3% by the end of the decade. By 2030, natural gas production is expected to increase significantly, from 103 bcf/d (billion cubic feet per day) in 2024 to 130-133 bcf/d, with 7-16 bcf/d directly attributed to AI-driven power demand.

- Industry Developments: Supporting this trend, GE Vernova’s natural gas turbine orders have nearly doubled, reflecting a projected 30% rise in U.S. natural gas demand by 2030. This underscores the critical role of natural gas and energy infrastructure in powering AI’s rapid expansion.iii

At Tortoise, we emphasize: “There’s no AI without EI.” The synergy between energy infrastructure and technological advancements underscores the critical role of natural gas and energy infrastructure in supporting the next industrial revolution.

A Resilient Sector with Compelling Valuations

The energy infrastructure sector continues to demonstrate resilience and offers attractive opportunities for investors through its combination of income potential, valuation upside, and stability.

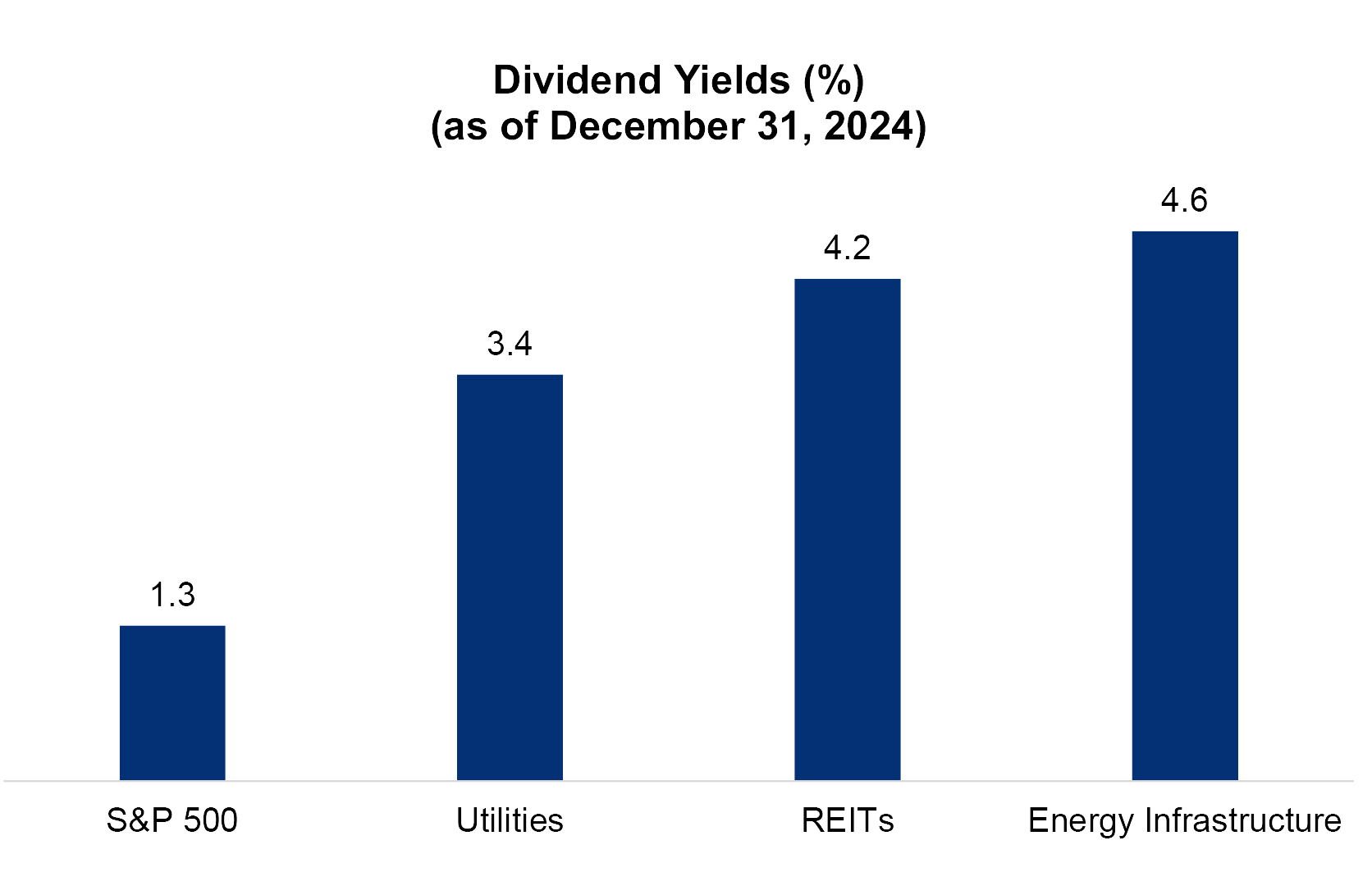

High Income

- Dividend yields in the energy infrastructure sector significantly outpace those of the S&P 500, utilities, and REITs, as shown in the chart on the right.

- Dividend growth is forecasted at 5%-7%iv for 2025, supported by strong fundamentals and stable cash flows.

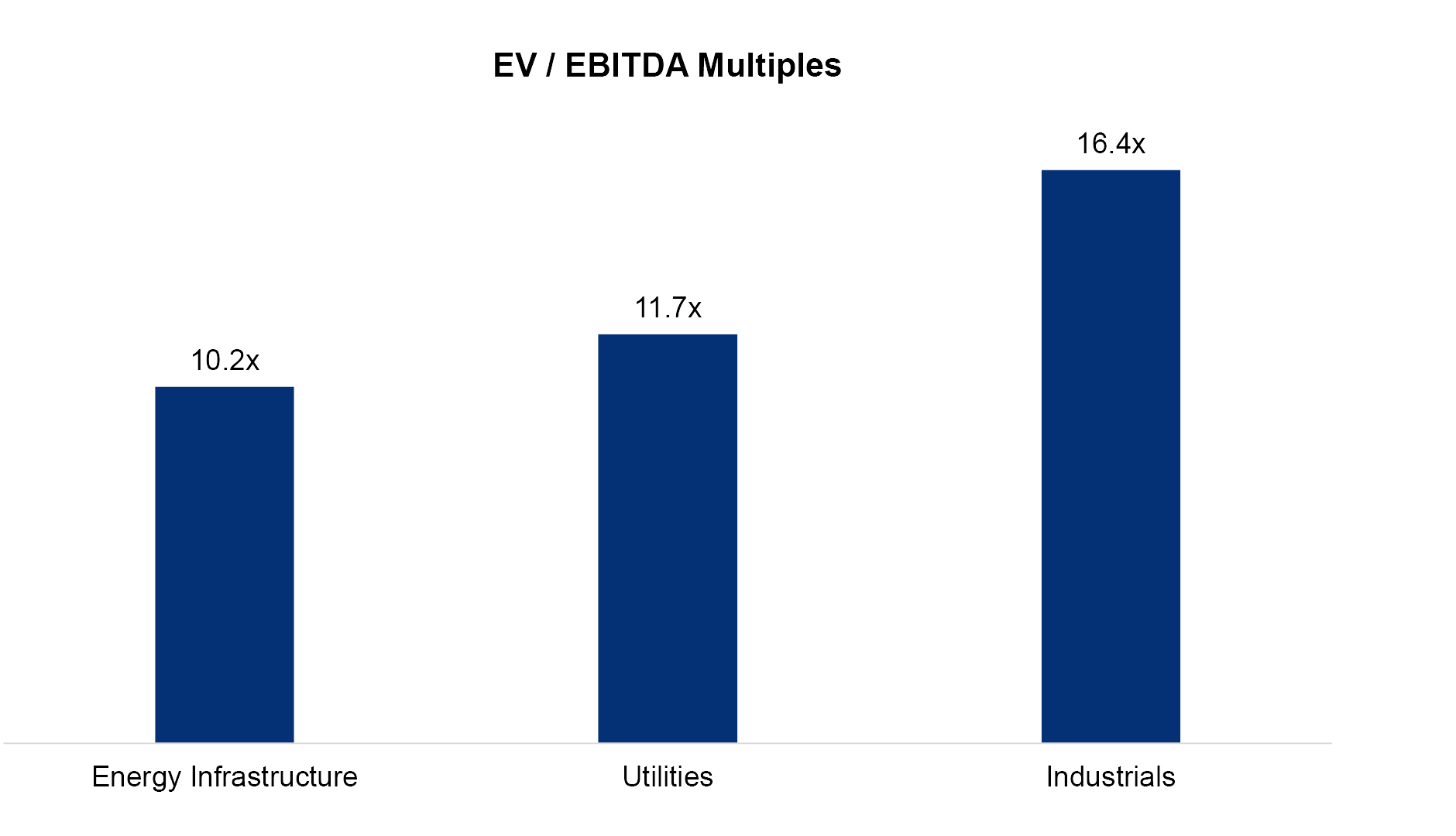

Valuation Upside

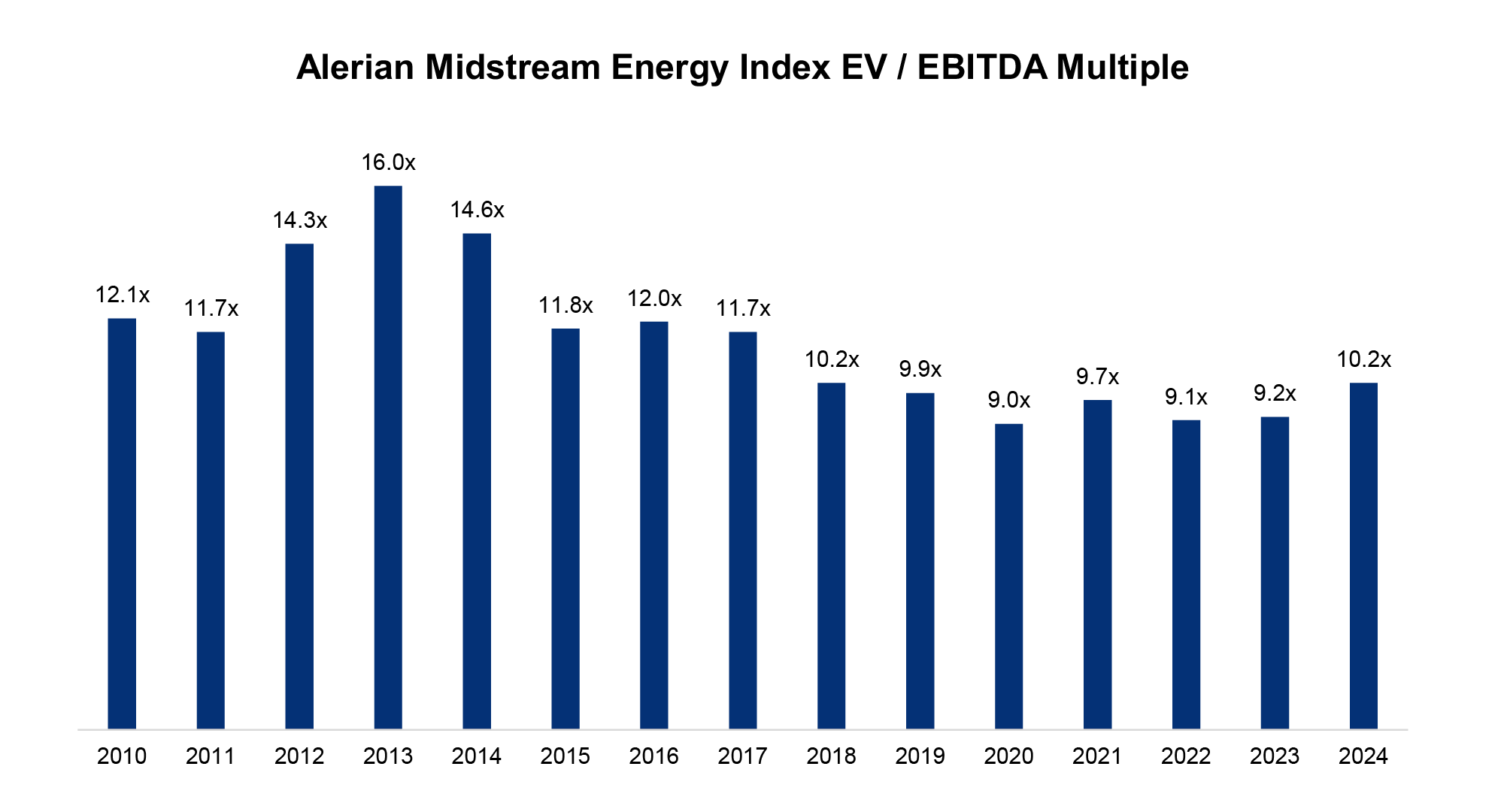

- EBITDA multiples are currently at 10.2x, below historical averages and those of comparable sectors like utilities and industrials, as illustrated in the following chart.

- This gap highlights the potential for multiple expansion as investor sentiment and market dynamics improve.

- The historical trend in EBITDA multiples, as demonstrated in the Alerian Midstream Energy Index chart below, highlights the potential for multiple expansion as investor sentiment and market dynamics improve.

Lower Volatility

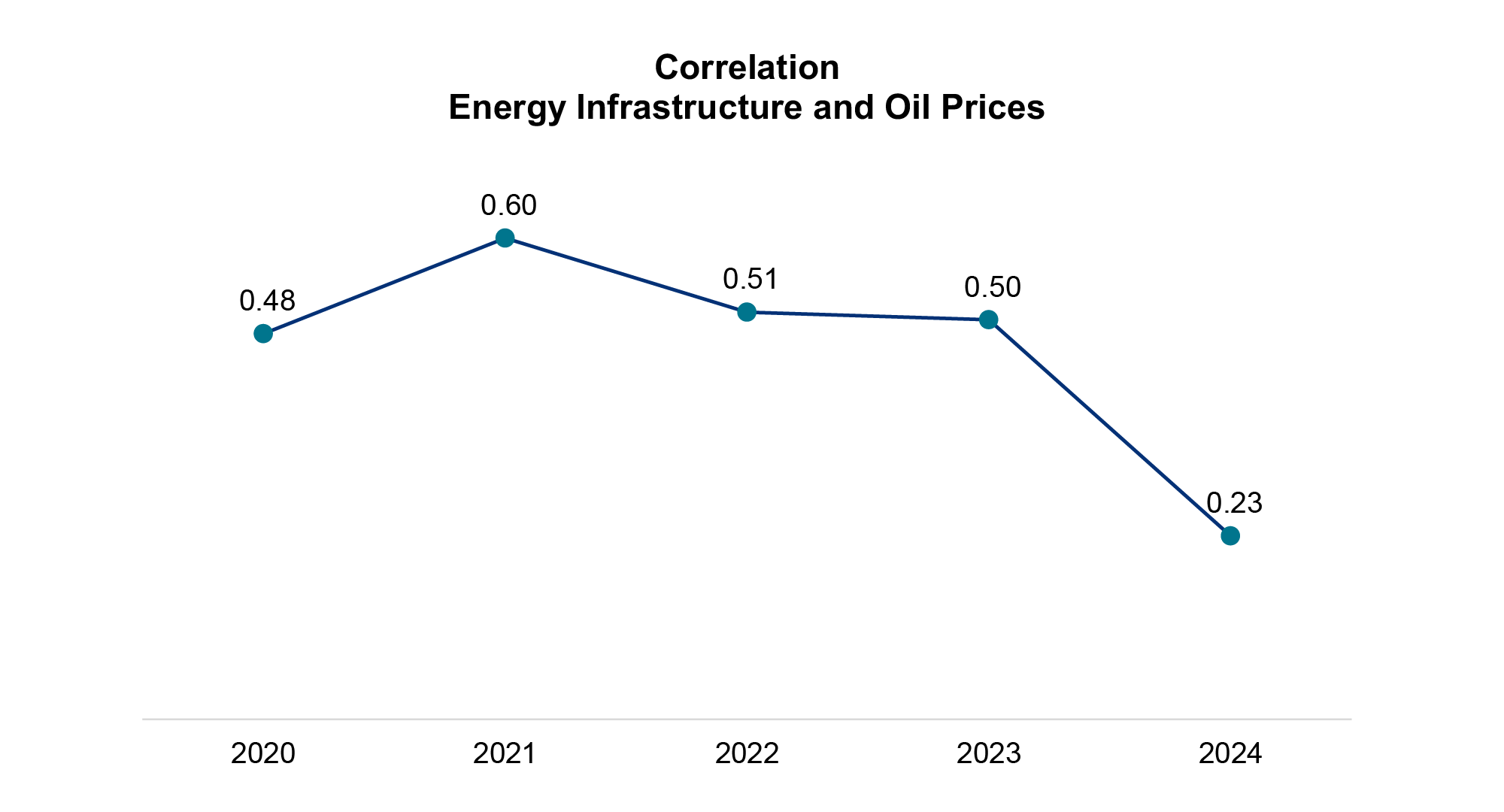

- The sector has shown reduced correlation with crude oil prices, which we expect to persist into 2025, as highlighted in this correlation chart.

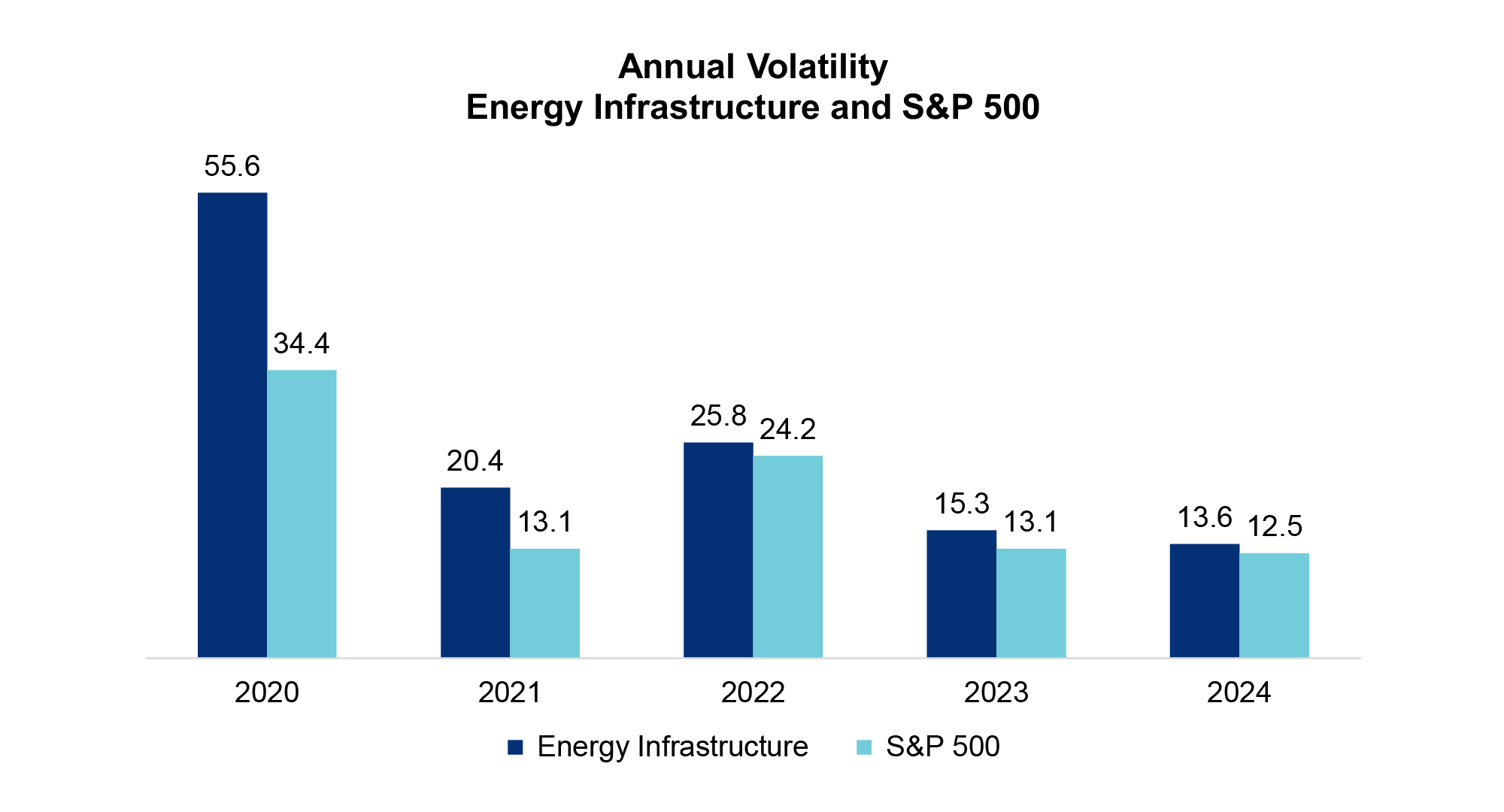

- Additionally, the sector has experienced continued declining volatility, as demonstrated in this annual volatility chart. Into 2025, we expect reduced volatility to persist, boosting energy infrastructure’s appeal for income-focused, risk-averse investors.

These factors combine to position energy infrastructure as a compelling investment choice, balancing high yields, potential growth, and reduced risk in an evolving market landscape.

Energy Exports: A Driver for Growth

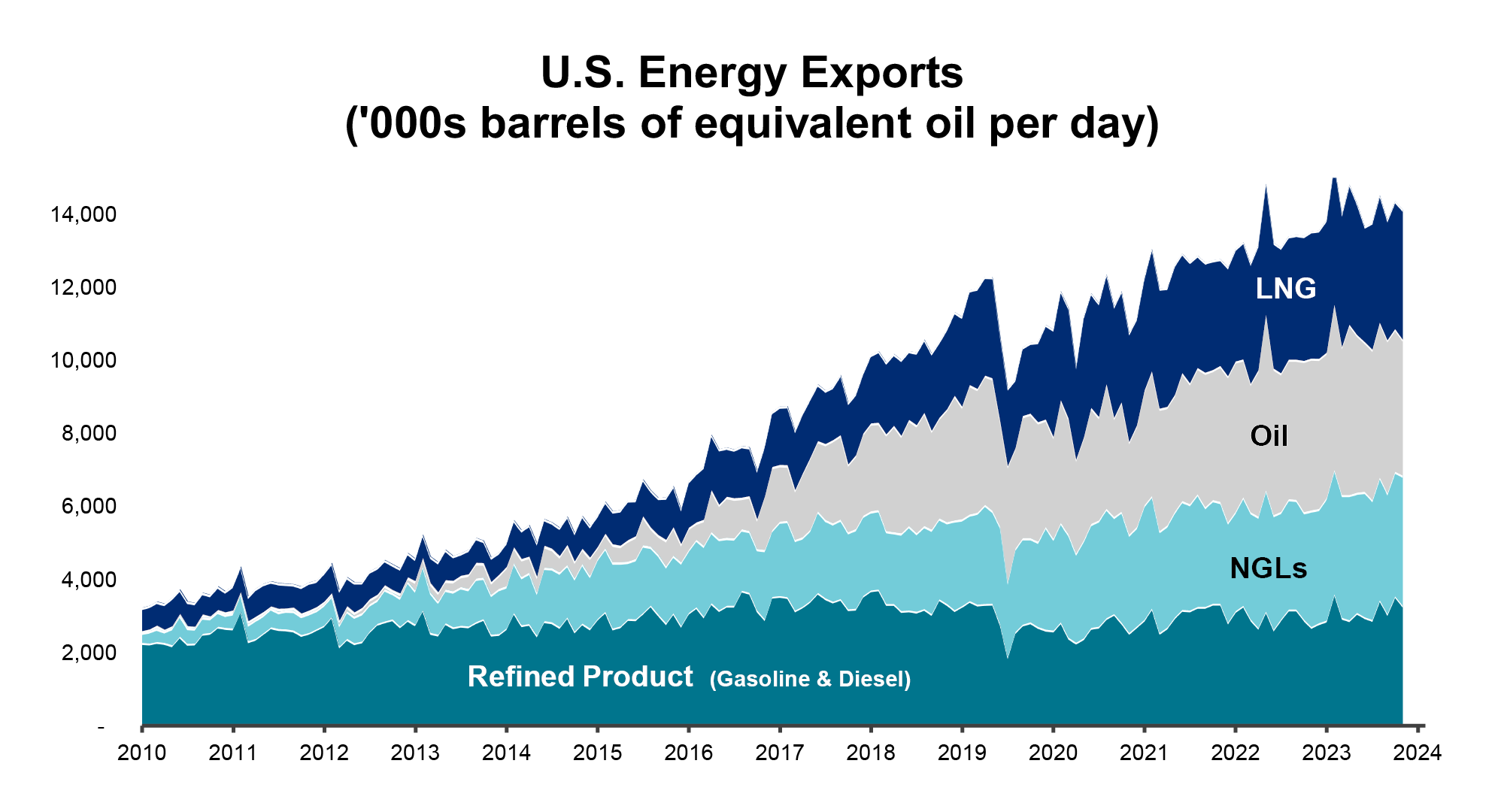

The United States leads the world in energy exports, a dynamic force driving growth in energy infrastructure. The chart below illustrates the rapid growth in U.S. energy exports across refined products, natural gas liquids (NGLs), crude oil, and liquefied natural gas (LNG), emphasizing the sector’s resilience and expansion.

Liquefied Natural Gas (LNG)

- LNG exports have achieved an impressive 18% compound annual growth rate (CAGR)v.

- These exports bolster energy security in Europe while reducing emissions in Asia by displacing coal for power generation.

Natural Gas Liquids (NGLs)

- NGLs, critical for producing petrochemicals and various consumer products, have seen exports grow at an 11% CAGRv over the past decade.

- Their versatility underscores their importance to both domestic industries and international markets.

Crude Oil

- U.S. crude oil exports have surged at a 27% CAGRv since 2015, driven by robust global demand.

- This growth reflects the expanding role of U.S. production in meeting the world’s energy needs.

With sustained growth across LNG, NGLs, and crude oil exports, the U.S. is well-positioned to support infrastructure expansion and drive long-term value for investors and the broader economy.

Sustainability Through Natural Gas

We believe that natural gas is a cornerstone in the transition to a more sustainable energy future, offering a bridge between traditional fossil fuels and cleaner energy sources. Its environmental and practical benefits highlight its critical role in the global energy landscape:

Lower Emissions:

- As the cleanest-burning fossil fuel, natural gas significantly reduces greenhouse gas emissions compared to coal.

- Its use in power generation, heating, and industrial processes contributes to improved air quality.

Integration with Renewables:

- Natural gas complements renewable energy sources like wind and solar by providing the reliability and flexibility needed to balance intermittent energy supply.

- This synergy ensures a more stable and efficient energy system.

Support for Emerging Technologies:

- Natural gas plays a pivotal role in enabling advancements in energy-efficient technologies.

- It supports the development of cleaner alternatives, such as hydrogen, further driving sustainability efforts.

Scalability and Availability:

- With its widespread availability and cost-effectiveness, natural gas remains a practical solution for meeting growing global energy demands while minimizing environmental impact.

Looking ahead to 2025 and beyond, the role of natural gas is expected to expand, solidifying its position as an essential and sustainable energy source in the global transition to cleaner energy systems.

The Conclusion

Energy remains the foundation of economic growth and modern life. In 2025, the continued rise in U.S. energy production will play a critical role in supporting global economic expansion, enhancing energy security, and addressing energy poverty worldwide.

The emergence of AI is set to redefine the energy landscape, creating a powerful intersection between the energy and technology sectors and unlocking a transformative new source of growth. Energy serves as the lifeblood of the global economy, with energy infrastructure acting as its circulatory system, ensuring the seamless delivery of essential resources.

With increasing demand, AI-driven innovation, and compelling valuations, the energy infrastructure sector is well-positioned for robust potential returns in 2025, reinforcing its vital role in driving economic progress.

Disclosures

The information in this piece reflects TCA views and opinions as of date herein which are subject to change at any time based on market and other conditions. This commentary contains certain statements that may include “forward-looking statements.” All statements, other than statements of historical fact, included herein are “forward-looking statements.” Although Tortoise believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect, Actual events could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this publication. TCA does not assume a duty to update these forward-looking statements. The views and opinions in this commentary are as of the date of publication and are subject to change. This material should not be relied upon as investment or tax advice and is not intended to predict or depict performance of any investment. This publication is provided for information only and shall not constitute an offer to sell or a solicitation of an offer to buy any securities.

Past performance is no guarantee of future results. It is not possible to invest directly in an index.

The Alerian Midstream Energy Index is a broad-based composite of North American energy infrastructure companies. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price return basis (AMNA) and on a total-return basis (AMNAX). The S&P 500® Index is an unmanaged, market-value weighted index of stocks that is widely regarded as the standard for measuring large-cap U.S. stock market performance.

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) is a non-GAAP measure used to provide an approximation of a company’s profitability. This measure excludes the potential distortion that accounting and financing rules April have on a company’s earnings; therefore, EBITDA is a useful tool when comparing companies that incur large amounts of depreciation expense because it excludes these non-cash items which could understate the company’s true performance. Liquefied Natural Gas (LNG) is a natural gas that has been cooled to a liquid state for shipping and storage – the volume in this state is about 600 times smaller than in its gaseous state, able to transport for much longer distances when pipeline transport is not feasible. Natural gas liquid (NGL) is liquid or liquefied hydrocarbons produced in the manufacture, purification and stabilization of natural gas. Their characteristics vary, ranging from those of ethane, butane and propane to heavy oils. NGL’s are either distilled with crude oil in refineries, blended with refined petroleum products or used directly depending on their characteristics.

iAlerian Midstream Energy Index and Tortoise Capital estimates

iiStatistical World of Energy, Energy Institute, June 2024

iiiGE Vernova Investor Update as of December 10, 2024

ivTortoise Capital estimate

vEIA as of December 31, 2024