In recent years, we have heard investors express their energy allocation based on the perceived treatment of the sector by the current and forthcoming administrations. However, we believe it is best to ignore the prevailing political rhetoric and focus on the fundamentals. With the pivotal 2024 presidential election on the immediate horizon, the investment team at Tortoise Capital conducted a 20-year deep dive into the U.S. energy sector performance under different administrations.

Historical Perspective: Political Parties and the U.S. Energy Sector

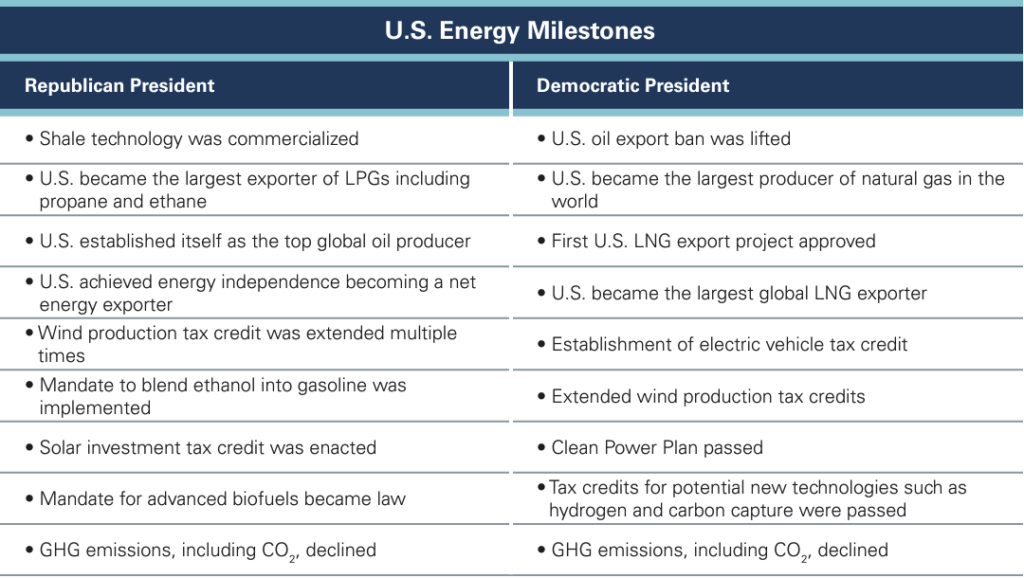

Despite oversimplified energy policy messaging from politicians on both sides of the aisle, the U.S. energy sector has evolved into a complex and indispensable entity. It plays a crucial role in ensuring energy security and reliability, thereby fostering consistent global economic growth. Historical data highlights the resilience and growth of the U.S. energy sector across different administrations. 2005 was a landmark year that altered the course of the U.S. energy sector. Shale technology that combines hydraulic fracturing and horizontal drilling catapulted the U.S. into the position of the world’s most critical supplier of essential energy products such as natural gas, propane, ethane, and oil. In the nearly 20 years since 2005, four were governed by a Republican-aligned President and Congress and four under a Democrat-aligned President and Congress. However, the vast majority were governed by a divided government in which one party controlled the White House while the other controlled one or both houses of Congress. During President Obama’s tenure, the U.S. became the world’s largest producer of natural gas. Under President Trump, the U.S. ascended to become the largest global oil producer. Most recently under President Biden, the U.S. surpassed Qatar to become the leading exporter of liquified natural gas (LNG). These milestones have helped to solidify the U.S. as the largest global energy producer – a status it is likely to maintain over the next four years – and the world’s largest energy exporter.

Energy Sector Performance by the Numbers

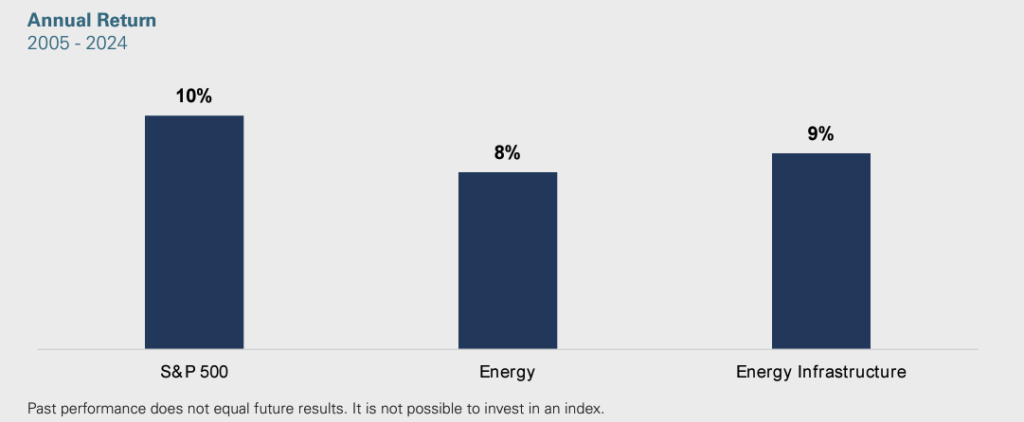

From an investor perspective, the compound average annual return delivered between 2005 and 2024 is consistent with the long-term average.

The chart above illustrates the 10% compound annual return of the S&P 500 from 2005 through 2024 (as of August 15, 2024). The returns of the energy sector, as represented by the S&P 500 Energy Index, and the energy infrastructure sector, as represented by the Alerian MLP Index, kept pace with the S&P 500, rising 8% and 9%, respectively. In 10 of the last 20 years, the energy infrastructure sector has outperformed the S&P 500 on an annual basis.

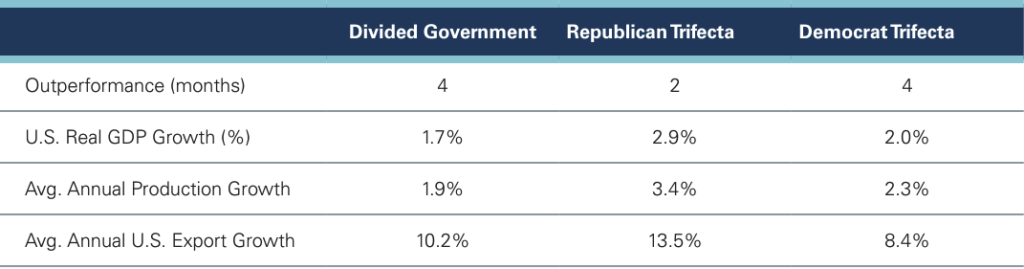

Annual average growth in real gross domestic product (GDP) ranged between 2% – 3% during different periods of political party control. Additionally, U.S. energy production growth averaged between 2% – 3% under various parties. U.S. energy export growth has been almost 14% annually during periods of Republican control but has also ranged between 8% – 10% during other periods as well. Both political parties have achieved many significant accomplishments related to the U.S. energy sector since 2005.

2024 Election Potential Impact on U.S. Energy Sector

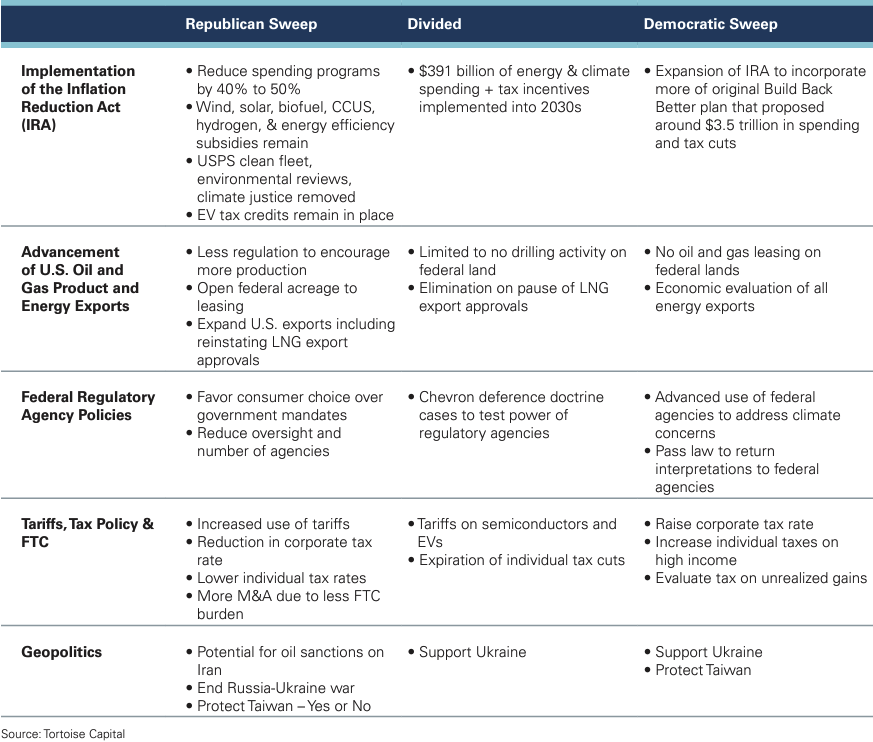

The bottom line, in our view, is that there is no conclusive evidence that the political parties will sway returns for investors. Real GDP growth has been fairly consistent under most scenarios, and the U.S. has improved energy security around the world by rapidly increasing energy exports. That said, the graphic below highlights several key issues impacting the energy sector and the potential actions based on the outcome of the election.

At Tortoise Capital, we remain neutral regarding the impact of electoral outcomes on the U.S. energy sector, as energy is an essential component of daily life and a foundational element for economic growth. Energy-related products play a crucial role in various economic activities, and global energy demand is projected to continue growing over the next four years, just as it has in 38 of the last 40 years. Leading into the upcoming election cycle, we anticipate global energy supply and demand will set new records and continue to be an area of focus for governments around the world. We are confident that economic fundamentals will prevail regardless of the outcome of the election. We believe fossil fuels will remain the most cost-effective, efficient, and reliable energy source for the foreseeable future. Regardless of the political climate, we are committed to navigating and leveraging the ever-evolving energy landscape to deliver value and growth opportunities for our investors.

Disclosures

The information in this piece reflects TCA views and opinions as of date herein which are subject to change at any time based on market and other conditions. This commentary contains certain statements that may include “forward-looking statements.” All statements, other than statements of historical fact, included herein are “forward-looking statements.” Although Tortoise believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect, Actual events could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this publication. Tortoise does not assume a duty to update these forward-looking statements. The views and opinions in this commentary are as of the date of publication and are subject to change. This material should not be relied upon as investment or tax advice and is not intended to predict or depict performance of any investment. This publication is provided for information only and shall not constitute an offer to sell or a solicitation of an offer to buy any securities. This publication cites information from other sources. While we believe such information to be accurate, we do not warrant to the accurateness of such information. We believe any information presented in this piece that is derived from third parties is reliable, though we do not guarantee its accuracy.

Past performance is no guarantee of future results. It is not possible to invest directly in an index.

The S&P 500® Index is an unmanaged, market-value weighted index of stocks that is widely regarded as the standard for measuring large-cap U.S. stock market performance. The S&P Energy Select Sector Index is a modified market capitalization-based index of S&P 500 companies in the energy sector that develop and produce crude oil and natural gas and provide drilling and other energy related services. Returns include reinvested dividends. The Alerian MLP Index is the leading gauge of energy infrastructure master limited partnerships (MLPs). The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMZ) and on a totalreturn basis (AMZX).