Introduction

In 2019 we published a white paper titled “The Teal Energy Deal”. This white paper is a follow up and will feature various solutions to facilitate the global transition to cleaner energy quickly and economically.

We believe that TortoiseEcofin is uniquely positioned as an expert on the energy transition and specifically the role that energy infrastructure companies will play in the evolving landscape.

TortoiseEcofin brings together strong legacies from Tortoise, with expertise investing across the energy value chain for more than 20 years, and from Ecofin, which unites ecology and finance and has roots back to the early 1990s. While the stigma in the oil and gas industry had long been to avoid the topic of climate change, that motto has shifted and big players in the industry are working towards constructive climate solutions. We believe the biggest energy companies in the world today will continue to be the biggest energy companies in the world 30 years from now.

Overview: Energy is essential to our everyday needs

Before we dive into energy transition and its evolving new technologies, we would be remiss if we didn’t take a moment to discuss the importance of the energy we derive from fossil fuels. The modern economy as we know it is dependent on fossil fuels and almost everything we count on in our daily lives is tied to it. Energy transitions are slow, typically lasting 50 – 80 years and occur at different paces globally due to regulations, the sway of incumbency, or uncertainty around new technologies. While the European Union and the United States are focusing on renewable development, India’s energy transition is investing billions of dollars to build its natural gas infrastructure. This investment will ween India off carbon intensive pollutants used for power generation to less carbon intensive liquid petroleum gases. While the energy sources may change from liquids to gases or from carbon intensive to carbon neutral, midstream infrastructure will remain instrumental in delivering energy to the global economy.

Access to energy, whether derived from fossil fuels or otherwise, is the key to improving people’s lives. Affordable energy has led to unprecedented improvements to the well-being of humans. Plastics, which are produced from natural gas liquids, are critical to manufacturing medicines, medical equipment (which was so critical in helping in the fight against COVID-19), and the building of water pipelines, wind blades, and solar panels.

Because developed economies are rich, we dismiss the energies the developing world needs for basic human dignity as dirty. Instituting policies to restrict domestic demand will simply result in the export of the energy and in turn sacrifice our energy independence to developing economies. For example, the United States’ energy independence will be exchanged for solar panels and batteries built by coal powered energy in overseas markets, such as China. Exporting our energy independence will lead to its own set of issues. The 2018 tariff dispute between the U.S. and China and COVID in 2020 awakened many companies to the risks embedded in their supply chains. Building a more environmentally friendly supply chain must not sacrifice the predictability of prices and supply for our current energy needs.

For the world to achieve the climate guidelines established in the Paris Accord, yet continue to provide more energy, a multipronged approach will be needed. The Executive Director of the International Energy Agency (IEA) Dr. Fatih Birol stated “almost half of the emissions reductions needed to reach net zero by 2050 will need to come from technologies that have not reached the market today.” The economic prize for disrupting the current global energy sector is substantial with an estimated total addressable market of over $11 trillion1. The approach to achieve a net-zero economy will be two-fold: 1. decarbonizing carbon emitting sectors and 2. increasing electrification across the various sectors.

Almost half of the emissions reductions needed to reach net zero by 2050 will need to come from technologies that have not reached the market today

Dr. Fatih Birol Executive Director

International Energy Agency (February 3, 2021)

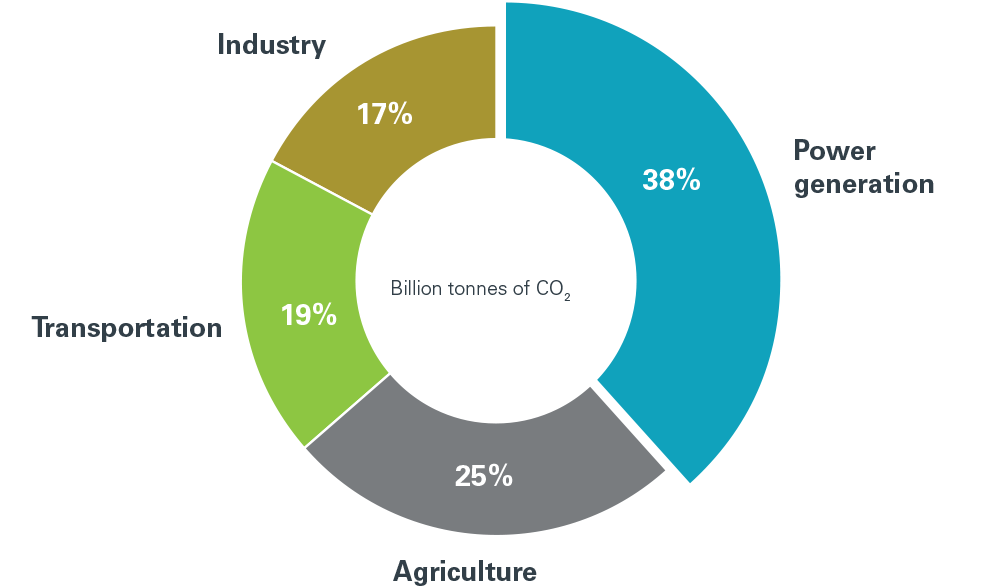

Sources of CO2 emissions and emerging technologies to help combat each

As the world moves towards a “greener” future and limiting global warming to less than 1.5 degrees, roadmaps need to be adopted from all primary sources (power generation, agriculture, industry, and transportation) of global CO2 emissions. The table below lays out the sectors and technologies that we believe are best positioned to implement efficient and reliable methods in limiting and reducing overall CO2 emissions. The goal for the energy industry is to produce more energy with less carbon. This paper will define how new technology impacts energy companies and what companies are doing to participate in each sector.

Source: IEA, Switch. Data represents estimated 2014 global anthropogenic CO2 emissions

Source: IEA, Switch. Data represents estimated 2014 global anthropogenic CO2 emissions

| Sources of global CO2 emissions | Emerging technologies |

|---|---|

| Industry | Carbon capture and storage, methane emission reduction through waste recycling |

| Power Generation | Substituting coal with gas and renewables (wind and solar) power generation, hydrogen, battery storage |

| Transportation | Electric vehicles, EV charging infrastructure, battery storage and recycling |

| Agriculture | Renewable natural gas, biodiesel, methane capture |

Source 1: Industry

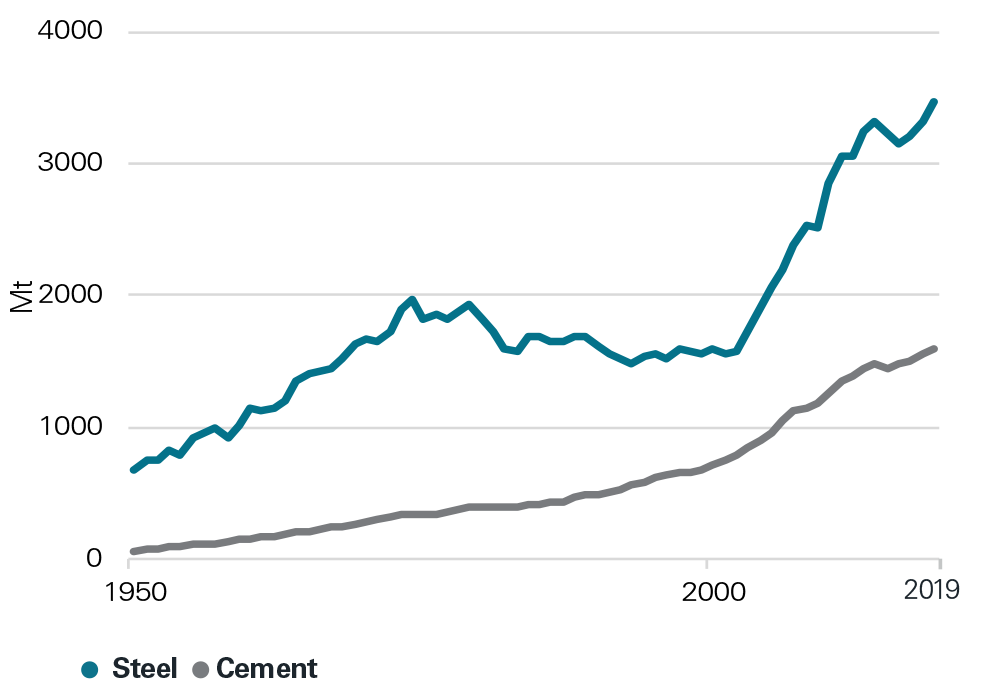

Demand for industrial products continues to expand alongside energy demand and growing carbon emissions2. Three of the largest industries responsible for the bulk of emissions are iron and steel, cement, as well as chemicals and petrochemicals. The production of these industries is reliant on fossil fuels and high temperature heat is needed in each industrial process. While innovation efforts are progressing, non-fossil fuel solutions do not currently provide the high temperature heat needed to serve the aforementioned industries on a wider scale. Thus, alternative solutions are needed in the short and medium timeframes that focus on reducing existing carbon emissions. Technologies that capture carbon and reduce methane are best positioned to help facilitate a solution in the interim.

Two different curves, same climate issues

Carbon dioxide emissions from production

Sources: Wang, P., Ryberg, M., Yang, Y. et al (2021); van Ruijven, B., van Vuuren, D., Boskaljon, W. et al (2016), BloombergNEF

Sources: Wang, P., Ryberg, M., Yang, Y. et al (2021); van Ruijven, B., van Vuuren, D., Boskaljon, W. et al (2016), BloombergNEFNote: Cement process emissions only. BloombergNEF steel production data from 2000 to 2019

Carbon capture utilization and storage (CCUS)

Carbon can be captured from the atmosphere or in higher concentrations directly from point sources, such as industrial exhaust where two-thirds of emissions are from point sources conducive to CCUS. Carbon capture technology has existed since WWII and was historically used to clean air in submarines and space ships. Now, the focus is on bringing technology to industrial scale, thereby improving per unit economics and ultimately a pathway to 40% cost reductions by 20303.

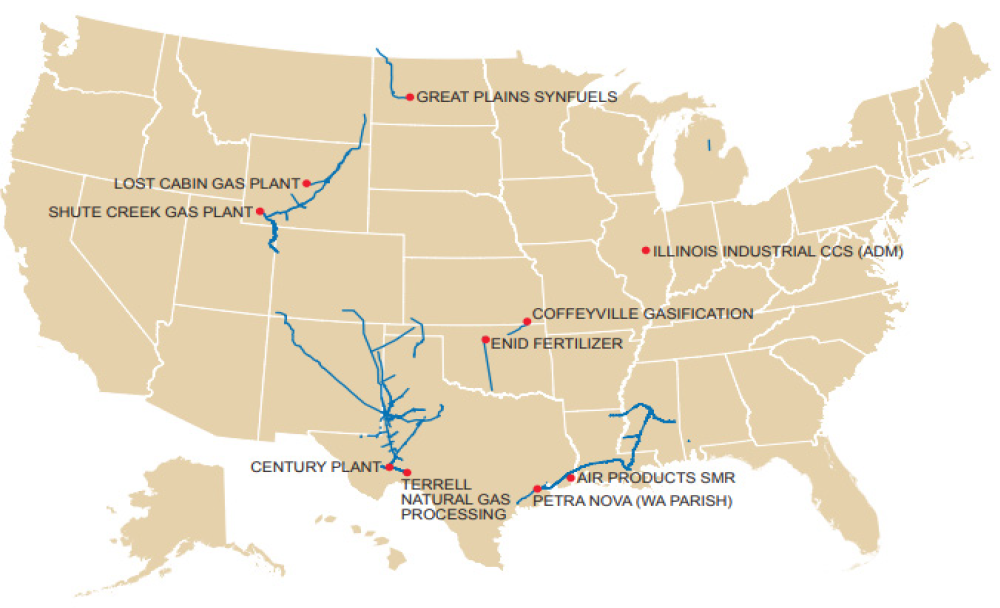

Today, there is infrastructure in place to accommodate growing volumes and the United States is a global leader in CCUS with approximately 4,500 miles of CO2 pipelines currently operational. More importantly, pipelines currently transporting hydrocarbons can be converted to CO2 service.

Existing U.S. CO2 pipeline infrastructure

CCUS is proposed under President Biden’s infrastructure bill. The SCALE Act, or Storing CO2 and Lowering Emissions Act, would authorize $2.1 billion in loans and grants for CO2 transport and storage infrastructure. If provided the necessary incentives, CCUS could grow 10x by 2030 and become a $1.0 trillion market by 2050. A leader in the carbon solutions space today is Denbury Resources. The company’s combined Scope 1 and Scope 2 emissions were exceeded by the captured industrial-sourced CO2, giving the company a net negative CO2 footprint for Scope 1 and Scope 2 emission. Between 2018 and 2019, the company’s 3.2 million metric tons of captured CO2 is the equivalent to annual greenhouse gas (GHG) emissions of almost 700,000 cars.4

While additional tax credits may be on the horizon, the market is presently seeing an acceleration in carbon capture announcements. In April 2021, Exxon Mobil’s president of Exxon’s Low Carbon Solutions business indicated it needs $100 billion or more from companies and government agencies to store 50 million metric tonnes of CO2 annually by 2030 along the Gulf Coast.5 Valero announced a partnership with Navigator and Blackstone to capture, transport, and store up to twelve million metric tonnes of CO2 sequestered annually from eight Midwest ethanol plants which includes a plan to construct 1,200 miles of new CO2 pipelines. The 12 million metric tonnes of CO2 would be equivalent to 1.5x the emissions of Kansas City! Next Decade is developing a CCS facility with its proposed Rio Grande LNG export terminal, which could reduce its carbon footprint by 90% vs. the original FERC filing. Finally, Kinder Morgan formed a New Energy Transition Ventures Group to further commercialize carbon transport and sequestration. Today the company operates more than 1,300 miles of CO2 pipeline, more than any company in the U.S.

Achieving a carbon neutral future will take a comprehensive approach and CCUS should be viewed as a top solution. Energy infrastructure companies, leveraging their expertise in designing, building, and operating pipelines, processing facilities, and gathering and distribution systems are ideally situated to be part of the solution.

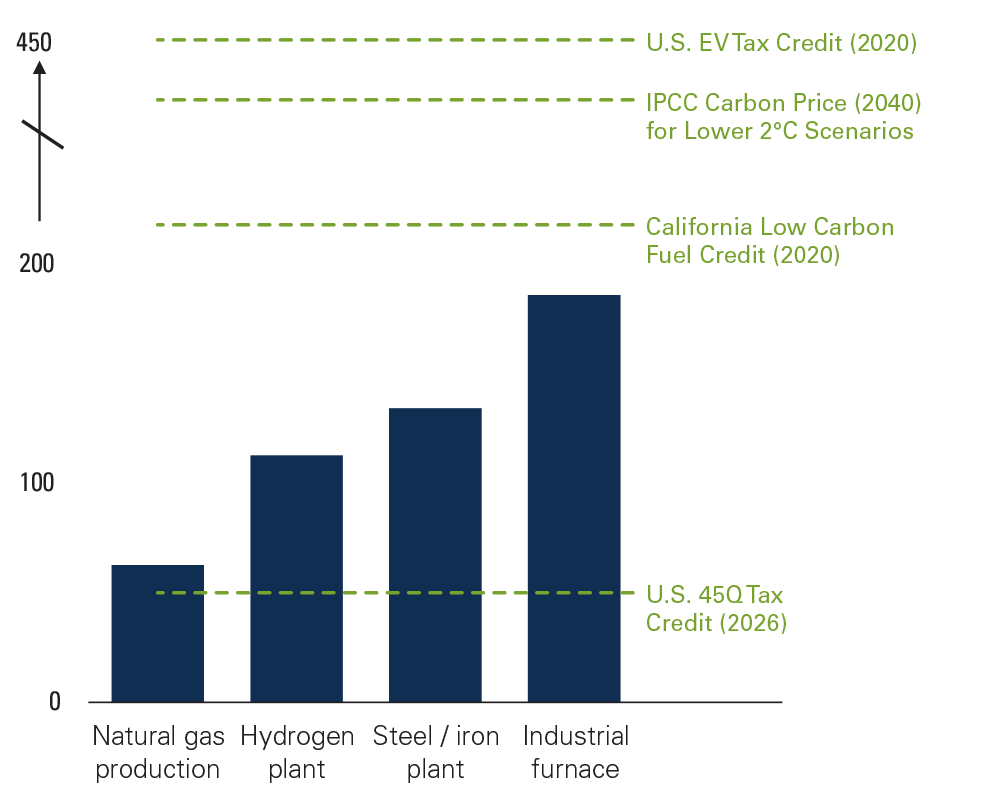

CCS Costs for mitigating industrial emissions

$/tonne CO2 for conventional technology

Source: National Petroleum Council report: A Roadmap to At-Scale Deployment of Carbon Capture, Use, and Storage (2019).

Source: National Petroleum Council report: A Roadmap to At-Scale Deployment of Carbon Capture, Use, and Storage (2019).

Methane emission reductions

According to the Oil & Gas Climate Initiative (OGCI), approximately 23% of current global warming is a result of methane. Though it stays in the atmosphere a shorter amount of time than CO2, methane is significantly more potent. The Intergovernmental Panel on Climate Change (IPCC) estimates methane to be 28 to 36 times more potent over 100 years than an equivalent amount of CO2. Unlike CO2, methane has immediate commercial value when not emitted.

Despite EPA performance regulations around methane emissions switching between Presidential Administrations the energy industry remains focused on emission reductions across the value chain. ONE Future, a group of 40 energy companies, including several midstream companies, has been focused on reducing methane emissions since 2014. Within midstream, Kinder Morgan highlighted its 25+ year focus on emission reduction and the company’s 2019 actual methane emissions resulting in just of 0.03%. Williams Companies pointed to methane emission reductions as a way to achieve up to 15% of its 2050 net zero target while MPLX LP is targeting 50% methane emission reduction by 2025. On a broader energy platform, EQT and Southwestern Energy have invested in pilot projects in which gas will be constantly monitored for methane emissions to demonstrate production of Responsibly Sourced Natural Gas. Utility CMS Energy detailed plans to meet a net-zero methane target by 2030, spending $400 million/year and large cap energy companies including BP, Chevron and ExxonMobil are pursuing climate initiatives through OGCI membership. Cheniere Energy, the largest U.S. LNG exporter, announced plans to start tagging every LNG cargo that is shipped starting in 2022 with a GHG emissions report. Consumers and companies are progressively committed to achieving environmental targets and are willing to pay a premium to have emissions reduced from wellhead to end user consumption.

Midstream ONE future members

Source 2: Power generation

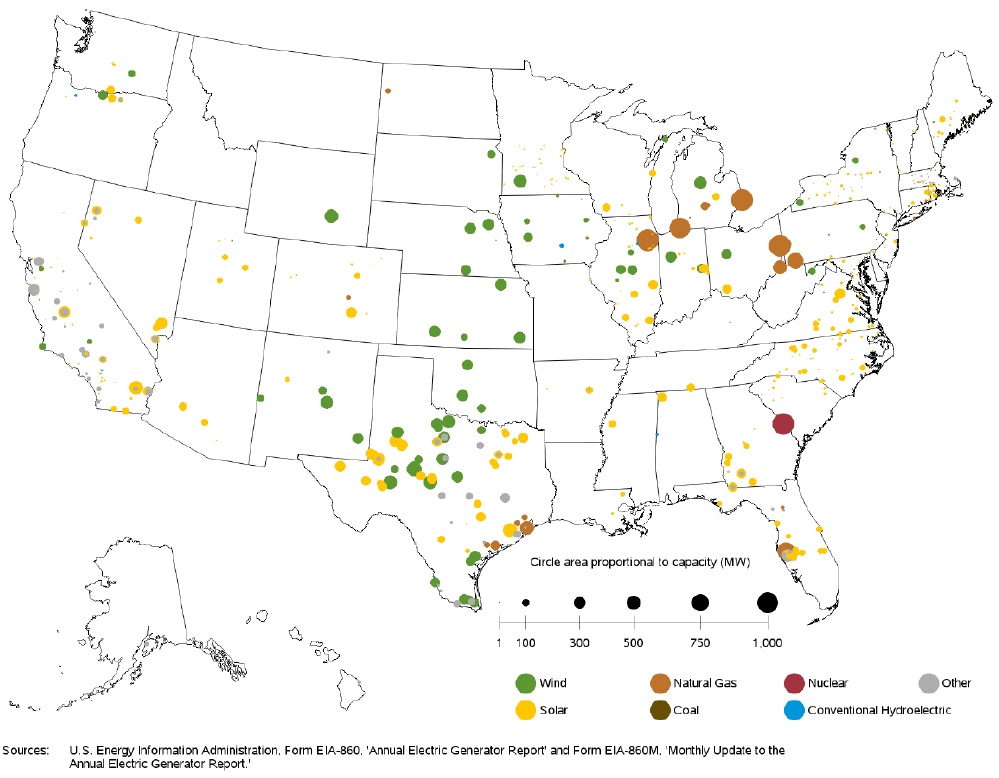

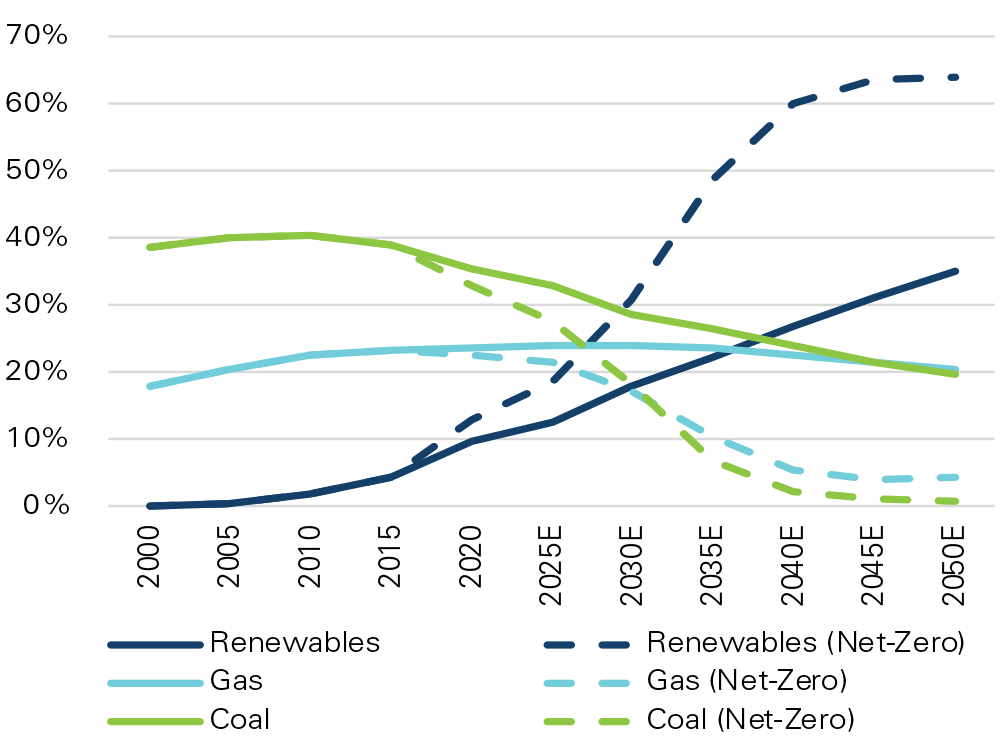

For the past several years, the focus has been on coal-fired power generation being substituted by natural gas and renewables (wind and solar) power generation. In the U.S., electricity production emissions are now less than transportation emissions, a shift that has occurred as coal plants are retired.6 Conversions away from coal will be a primary driver in reducing global emissions while emerging technologies are proven or developed. Natural gas will continue to be critical to power generation as it can generate baseload power while also being very effective at providing dispatchable power, increasing or decreasing as electrical capacity is needed. Wind and solar power generation will gain market share as costs come down significantly and those energy sources become more widely scaled. Even assuming an aggressive solar and wind grid expansion, we believe natural gas market share should remain steady.

According to the U.S. Energy Information Administration’s (EIA) latest inventory of electricity generators, developers and power plant owners plan for approximately 40 gigawatts (GW) of new electricity generating capacity to start commercial operation in 2021. Solar will account for 39% of the capacity, wind will account for 31% of the capacity and natural gas will account for 16%.7 Reinforcing this shift, BP’s graph to the right illustrates how power generation market share will be dominated by renewables and gas in the coming decades. Like other emerging energy technologies, cost declines should accelerate with technological advances, best practices improvement, economies of scale and evolving battery chemistry.

As power generation and energy transitions, apprehension around energy security and new supply chains will remain relevant. For example, there will be increased scrutiny around the manufacturing of wind turbines and solar panels. Rare earth metals used in wind turbine generators and shortages of raw materials could, for example, impede growth in wind power. The expansion of electrification will ultimately lead to a significant increase in demand for copper. According to the IEA, half of the worldwide supply of copper is produced by China and Chile.

Even projects with good economics can be slowed by a small number of adversaries including NIMBY (not in my backyard) concerns. The massive size of wind turbines can lead to opposition from residents worried about obstructed views. Solar panels are less visible but face different concerns. Obtaining permits to use large areas of land for solar power can also be challenging. Finally, land used for solar farms cannot be used for agriculture related purposes. These uncertainties reinforce the point for a multi-pronged approach to the energy transition and a continued reliance on the existing natural gas infrastructure.

New electricity generation expected by source

(June 2021-May 2022)

Projected global generation by fuel share

Source: BP

Source: BP

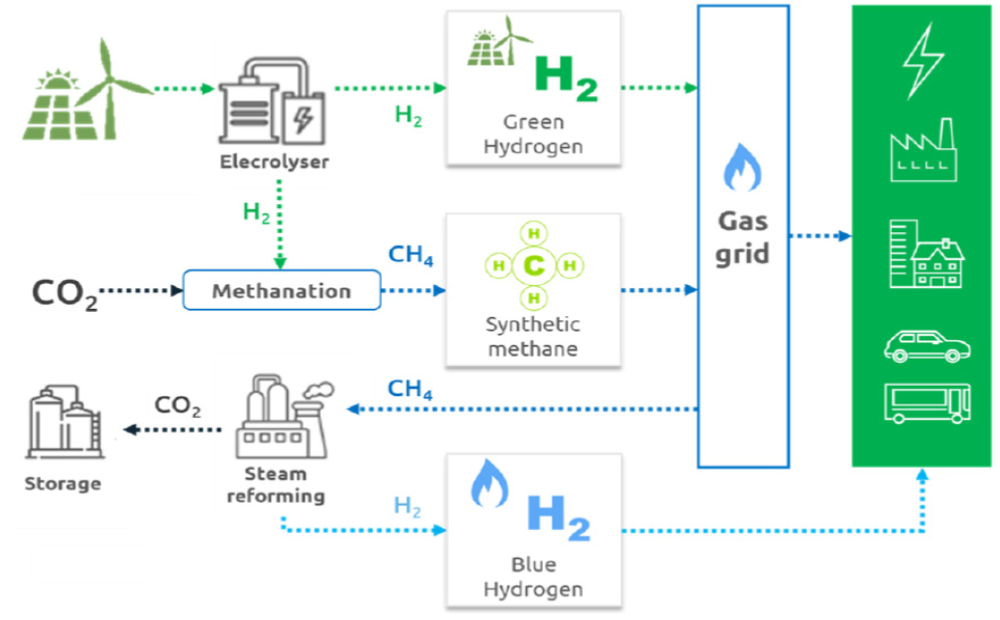

Hydrogen

Of all the potential new energy technologies, hydrogen could end up developing into a primary long-term alternative as a decarbonizing fuel. According to BloombergNEF’s Hydrogen Economy Outlook, hydrogen is estimated to potentially make up 24% of the world’s energy needs by 2050, growing from limited industrial use today to displacing fuels used in power, transportation, and heating. Hydrogen as a fuel source offers potential for CO2 abatement in currently hard to reach sectors, such as high heat use industry. Hydrogen produced by electrolysis that is powered by renewable generation, noted as green hydrogen, is carbon free but not yet cost competitive. Today, making green hydrogen using carbon-free electricity can cost four to six times more than making hydrogen from fossil fuels. Those costs are expected to fall with advances in electrolysis efficiency, lower costs of renewable energy inputs, and economies of scale from the industrial hubs being built around the world. New Fortress Energy is developing one of the first green hydrogen production projects in the U.S. The company’s gas fueled power plant in Ohio plans to run 15-20% hydrogen in its gas mix by November 2021 and 100% hydrogen in the next decade.

Power produced with natural gas with carbon capture (i.e. blue hydrogen) could be the most prevalent opportunity for hydrogen over the next decade. Blue hydrogen offers more affordable pricing driven by the vast amounts of gas reserves already identified globally. Blue hydrogen is scalable and can serve as a reliable fuel in the coming decades by leveraging existing energy infrastructure and allowing green hydrogen costs to continue to decline. Blue hydrogen can capture 95% of CO2 emissions, nearly putting it on par with green hydrogen, but at a much more affordable price. There should be ample opportunity for these solutions, particularly near industrial complexes.

Energy infrastructure companies are beginning to invest in hydrogen infrastructure projects with natural gas pipeline and distribution companies analyzing how hydrogen could be transported through their pipelines. For example, operators have begun to assess the near-term ability to mix hydrogen into the natural gas stream in existing pipelines and generally believe current systems could handle anywhere from 10%-30% hydrogen with minimal capex. Pipeline embrittlement, if hydrogen content gets too high, and additional compression (due to hydrogen being less dense than natural gas) are areas where investment will be needed. Still retrofitting an existing pipeline will be much less costly than building a new pipeline. Pipeline companies, with their rights of way and engineering expertise, should be well positioned to retrofit existing pipelines or build new pipelines transporting hydrogen. By leveraging existing natural gas infrastructure, the energy transition can be accelerated to support the transition towards zero carbon fuels.

Hydrogen value chain

Battery storage

Battery storage, along with hydrogen are energy‐technologies with some of the highest potential to accelerate the pace of decarbonization. Lithium-ion remains the preferred, low-cost battery chemistry and companies are using software to optimize lithium‐ion battery storage. Other companies are exploring different chemistries using zinc and solid‐state to lengthen battery storage.

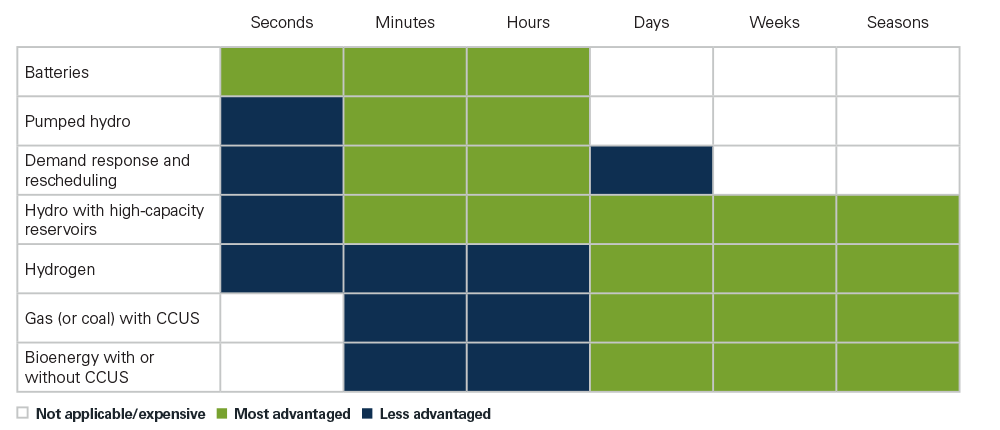

Technologies to help balance power system at different durations

Source: https://www.bp.com/en/global/corporate/energy-economics/energy-outlook/net-zero.html

Source: https://www.bp.com/en/global/corporate/energy-economics/energy-outlook/net-zero.html

Advancements in battery storage technology could be the most significant energy technology to change the game by accelerating the pace of decarbonization. Larger battery capacity will increase the amount of time that energy can be stored, leveraging the use of solar and wind for electricity. Bloomberg New Energy Finance (BNEF) forecasts the energy storage market to grow from 17 GWh deployed as of 2018 to 2,850 GWh by 2040, representing $660 billion in investment over the next two decades.

Even in deregulated markets, such as Texas, investment in battery storage is being considered. Today, most current battery storage can operate at a maximum of four hours at a time before needing to be recharged. Utilities are using storage to shift energy to peak demand times, control frequency, provide reserves, and better utilize transmission and distribution. Natural gas solves the intermittency challenges by incorporating combined cycle natural gas facilities with renewables and battery storage. To this point, many leading utilities see natural gas as a vital part of the overall electric grid system. NextEra is modernizing gas-fired combined cycle facilities which are highly efficient and boosted by the abundance of low-cost natural gas in the United States.

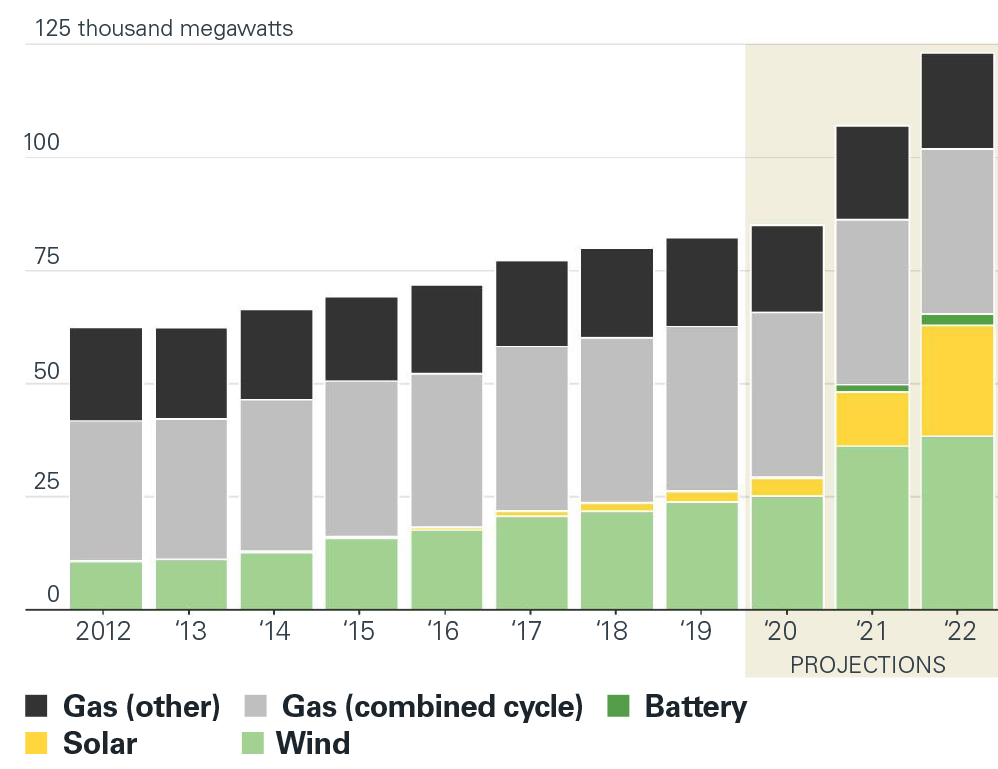

Texas power generation

Wind, solar and battery installations are growing quickly in Texas, while natural-gas capacity has remained flat

Source: Electric Reliability Council of Texas

Source: Electric Reliability Council of Texas

Source 3: Transportation

One hundred years ago, mobility changed significantly as the horse buggy was replaced by the Ford Model T. That transition took around two decades between 1920 and 1940. Today, the transportation sector is again on the precipice of significant changes as vehicles transition from internal combustion engines to electric vehicles. We expect electric vehicles to reduce carbon emissions in the transportation sector in the coming decade just as wind and solar installations drove down carbon emissions in the power generation sector in the last decade.

The transportation industry comprises approximately one-fifth of the 33.9 gigatons of carbon emissions worldwide, according to the IEA’s Net Zero by 2050 report. In Europe, countries such as the United Kingdom, the Netherlands, Sweden, Germany and France are phasing out the internal combustion engine or ICE vehicles over the next two decades. In the U.S., California passed regulations requiring half of trucks sold in the state to be zero emissions by 2035 and 100% by 2045. Electric vehicle (EV) penetration rates are expected to increase as the cost of lithium‐ion battery packs decline from $200 per kilowatt‐hour (kwh) today to $94/kwh in 2024 and $52/kwh in 2030. EVs could reach price parity with ICE vehicles in the U.S. and Europe between 2024 – 2026 and in China between 2028 – 20308. To facilitate this transition, electric vehicles, battery storage, and EV charging stations will be critical components.

Electric Vehicles (EV)

The number of electric vehicles has continued to grow rapidly but off a very low base. The electrification of the transportation sector has evolved at various paces for the different automotive and freight fleets globally. According to the BloombergNEF 2021 Long-Term Electric Vehicle Outlook, there are 12 million passenger EVs on the road globally today and amounting to just 1% of the global fleet. Passenger EV sales are projected to skyrocket in the coming years, going from just over 3 million vehicles in 2020 to 14 million vehicles in 2025.

This rapid growth won’t be without challenges. Mineral resources such as lithium, cobalt, manganese, and graphite are critical components into making the electric vehicle and its batteries. The IEA projects demand for these minerals from electric vehicles and battery storage will grow at least 30x by 2040.9 As battery costs have come down through technological advancements, raw materials are becoming a larger part of the battery cost structure. If those input costs rise because of supply limitations that could offset price reductions seen from economies of scale.

There are also unanswered questions and concerns about the geographical concentration of these rare minerals. In 2019, The Democratic Republic of the Congo (DRC) and People’s Republic of China (China) were responsible for some 70% and 60% of global production of cobalt and rare earth elements respectively according to the IEA9.The single country concentrated risk for these minerals cannot be ignored. Onshoring parts of the global supply chains for these minerals such as refining or processing, if possible, could be a helpful first step in eliminating some of this concentrated risk. Finally, the same environmental and social concerns that exist for fossil fuels need to be considered in the production of rare earth minerals.

EV charging stations

With the electric vehicle market poised for tremendous growth auto manufacturers will rely on and provide incentives to charging station developers to provide adequate charging infrastructure. Over $450 billion of investment is expected in charging infrastructure by 2040, with public infrastructure making up 45%10. The U.S. Department of Energy Alternative Fueling Station Locator showed over 49,000 charging stations as of June 2021. President Biden’s American Jobs Plan includes programs to build a network of 500,000 EV chargers by 2030.

Despite the large and growing number of charging stations, to change consumer perceptions around range anxiety, massive expansion will continue to be required. Drivers have been spoiled by the great number of gasoline stations across the country and investments will be required to assure there are an adequate number of places to recharge EVs. We expect the charging networks will ultimately be defined by consumer needs. There are EV chargers in retail areas where drivers can leave their car to charge while doing other things such as shopping or working. Other types of automobile fleets will require, and likely outsource, charging infrastructure development including car rental agencies, delivery services, and large consumer brands. Finally, the proliferation of ride sharing provides an investment opportunity for charging infrastructure used by employed drivers. Both Uber and Lyft have partnerships with EV charging station providers and Uber has stated on its website it will invest $800 million through 2025 to help drivers switch to electric vehicles.

EV battery storage

Improved battery technology will reduce battery anxiety and will likely increase the adoption rate of EV transportation. While in-home charging is expected to be the primary power source for traditional car owners, additional value lies in location and rapid development of charging speeds seen in DC Fast Charging model. With more consumers operating electric vehicles, increasing charge rates from DC Fast Charging will be critical to the electric vehicle growth story. EVgo forecasts a 100-mile charge time could be as low as 5 minutes at a 350kW DC fast charging station versus 3.3 hours for a Level 2 charging station.11

Source 4: Agriculture

The final major industry which can help drive decarbonization is agriculture. Agriculture is unique among the sectors already discussed because of its potential to help achieve net-zero emissions thorough negative carbon intensity. Greenhouse gases arise in numerous ways including the decomposition of mineral fertilizer, methane from rice production and the digestive process from ruminant livestock such as cattle used in farming. Capturing methane emissions from landfills and biosources and producing renewable natural gas and renewable diesel respectively, are two of the largest areas of focus. Both alternatives are considered nascent but are rapidly growing and will offer opportunities for midstream companies to participate in the energy transition.

Renewable natural gas

Renewable natural gas (RNG) is the product of naturally occurring methane produced when waste products decompose and undergo a treatment process turning the resulting methane mix into a synthetic natural gas. RNG takes organic waste that would otherwise decay, emitting methane, and instead replaces fossil fuel based natural gas, making it GHG neutral. RNG is considered carbon-negative if it is produced from waste products that once absorbed carbon dioxide. Today, a majority of RNG is a product of landfill gas, but similar processes undertaken on farms, at wastewater sites and using food waste also can produce RNG.

The production of RNG in the U.S. is estimated to have totaled nearly 60 trillion BTU in 2020, relative to over 34,000 trillion British thermal units (BTU) of fossil fuel-based natural gas. Most RNG projects are a product of local government incentives as costs of production and distribution of RNG remain far from competitive with fossil fuel-based natural gas production. RNG production from landfill gas costs anywhere from $7 to $20 per mmbtu with other sources costing up to $35 per mmbtu.

While RNG economics are driven by tax credits today, midstream energy companies are getting involved in the RNG supply chain. Kinder Morgan, in July 2021, announced an acquisition of Kinetrex Energy, an RNG producer and supplier. The RNG business is highly complementary to KMI’s existing business, as RNG is molecularly the same as methane and can flow on KMI’s network of gas pipelines. Williams Companies (WMB) is blending RNG produced on dairy farms and landfills into its natural gas streams and numerous gas utilities are developing plans to integrate RNG into their gas distribution systems as they continue to receive social and regulatory pressure to reduce carbon footprints.

The opportunities for renewable natural gas should continue to grow in the coming years. SoCalGas, which serves over 20 million customers and is the largest U.S. natural gas distribution utility, plans to deliver 20% renewable natural gas to its customers by 2030.12

Operating RNG projects

Source: Bloomberg New Energy Finance; Renewable Natural Gas, Low Emissions, High Potential

Source: Bloomberg New Energy Finance; Renewable Natural Gas, Low Emissions, High Potential

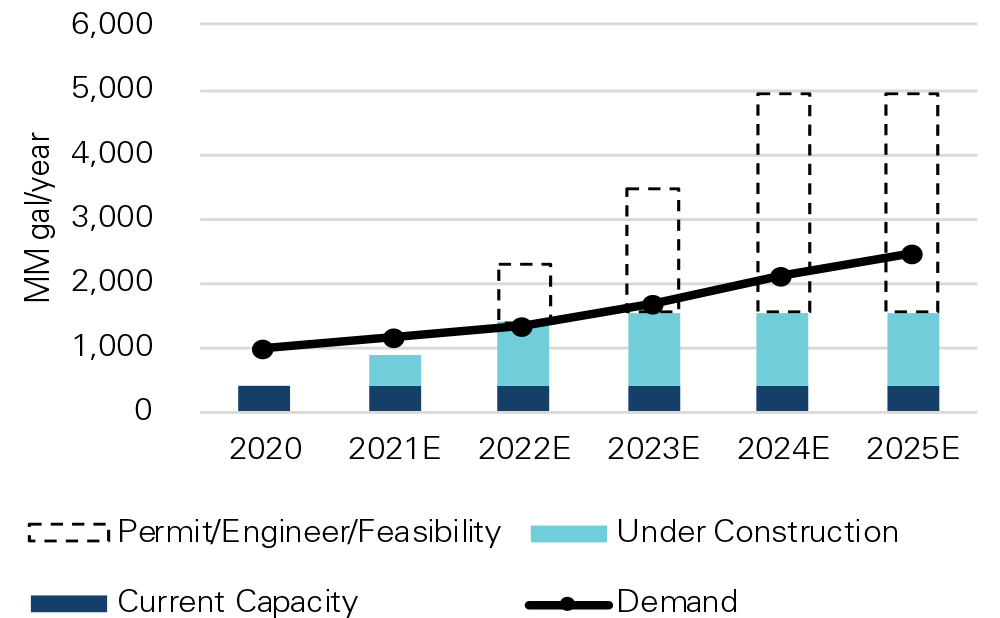

Renewable diesel / biodiesel

U.S. refiners are also looking at ways to participate in the energy transition and increase returns via renewable diesel projects. Renewable diesel inputs can be animal or vegetable fats with the most common sources being soybean oil, corn oil, used cooking oil, and beef tallow. Two U.S. renewable diesel (RD) projects were announced in 2020 with one additional project announced in 2021. RD projects extend the useful life of refining assets and associated logistics. Each gallon of RD requires an average of 7.5 pounds of feedstock, making logistics critical to production. Like renewable natural gas, renewable diesel’s profitability is primarily due to tax credits at present.

Renewable diesel requires hydrotreating, thus refineries with this capability are best suited to be retrofitted. Unlike biofuel, which has a 20% blend limit, RD is indistinguishable from traditional diesel and can be used in concentrations up to 100. Finally the lack of a blend wall gives RD an advantage in low carbon fuel programs. Both renewable diesel and biofuels can reduce the GHG impact by 40-90%13. Valero is an industry leader in terms of renewable diesel while midstream operators MPLX LP and Magellan Midstream Partners are blending renewable fuels with traditional refined product.

North American renewable diesel supply/demand

Source: Morgan Stanley

Source: Morgan Stanley

To conclude, the energy transition has led to new investments and projects being announced at a frenetic pace. In our view, energy infrastructure companies will play a significant role in this transition. As business plans progress, companies should be able to re-purpose their existing assets while simultaneously helping to reduce CO2 emissions. Some companies will adapt and lead while others will be left behind. As with all energy transitions, there will be business winners and losers with significant sums of capital to be gained or lost in the years ahead.

1Exxon Mobil 4Q2020 earnings presentation

2IEA, Ind Contentustry direct CO2 emissions in the Sustainable Development Scenario, 2000-2030

3BofA Global Research, Global Oil & Gas, 13 April 2021

4Denbury Corporate Presentation June 2021

5“Exxon floats $100 bln carbon storage project requiring public, private financing” Reuters, April 19, 2021

6EPA Sources of Greenhouse Gas Emissions, 2019

7EIA Today in Energy, January 11, 2021

8Nuvve Investor Presentation, November 2020

9IEA The Role of Critical Minerals in Clean Energy Transitions

10BNEF

11EVgo Investor Relations Presentation

12Sempra Energy 1Q2021 Earnings Results Presentation

13RBC Capital Markets: Renewable Diesel: If you Build It, They Will Come

Disclosures

This commentary is provided for discussion and informational purposes only to provide background information with respect to the market generally, and is not an offer to sell or the solicitation of an offer to buy an interest in any current or future vehicles or funds controlled by Tortoise, and you acknowledge that you are not relying on the information contained in this presentation as the basis for any such investment decision you may make in the future. Prospective investors should not construe this overview or any other communication as legal, accounting, tax, investment or other advice, and each prospective investor should consult with their own counsel and advisers as to all legal, tax, regulatory, financial and related matters concerning an investment. This commentary contains certain forward-looking statements. These forward-looking statements include all statements regarding the intent, belief or current expectations regarding matters covered and all statements which are not statements of historical fact. The forward-looking statements involve known and unknown risk, uncertainties, contingencies and other factors, many of which are beyond our control. Since these factors can cause results, performance and achievements to differ materially from those discussed in the presentation, you are cautioned not to place undue reliance on the forward-looking statements. This commentary reflects our views and opinions and are subject to change at any time based on market and other conditions. We disclaim any responsibility to update these views. These views should not be relied on as investment advice or an indication of trading intention. Discussion or analysis of any specific company-related news or investment sectors are meant primarily as a result of recent newsworthy events surrounding those companies or by way of providing updates on certain sectors of the market. Through our family of registered investment advisers, we provide investment advice to related funds and others that includes investment into those sectors or companies discussed in this commentary. As a result, we stand to beneficially profit from any rise in value from many of the companies mentioned herein including companies within the investment sectors broadly discussed.

The New Age of Energy Infrastructure